1

Please refer to important disclosures at the end of this report

1

1

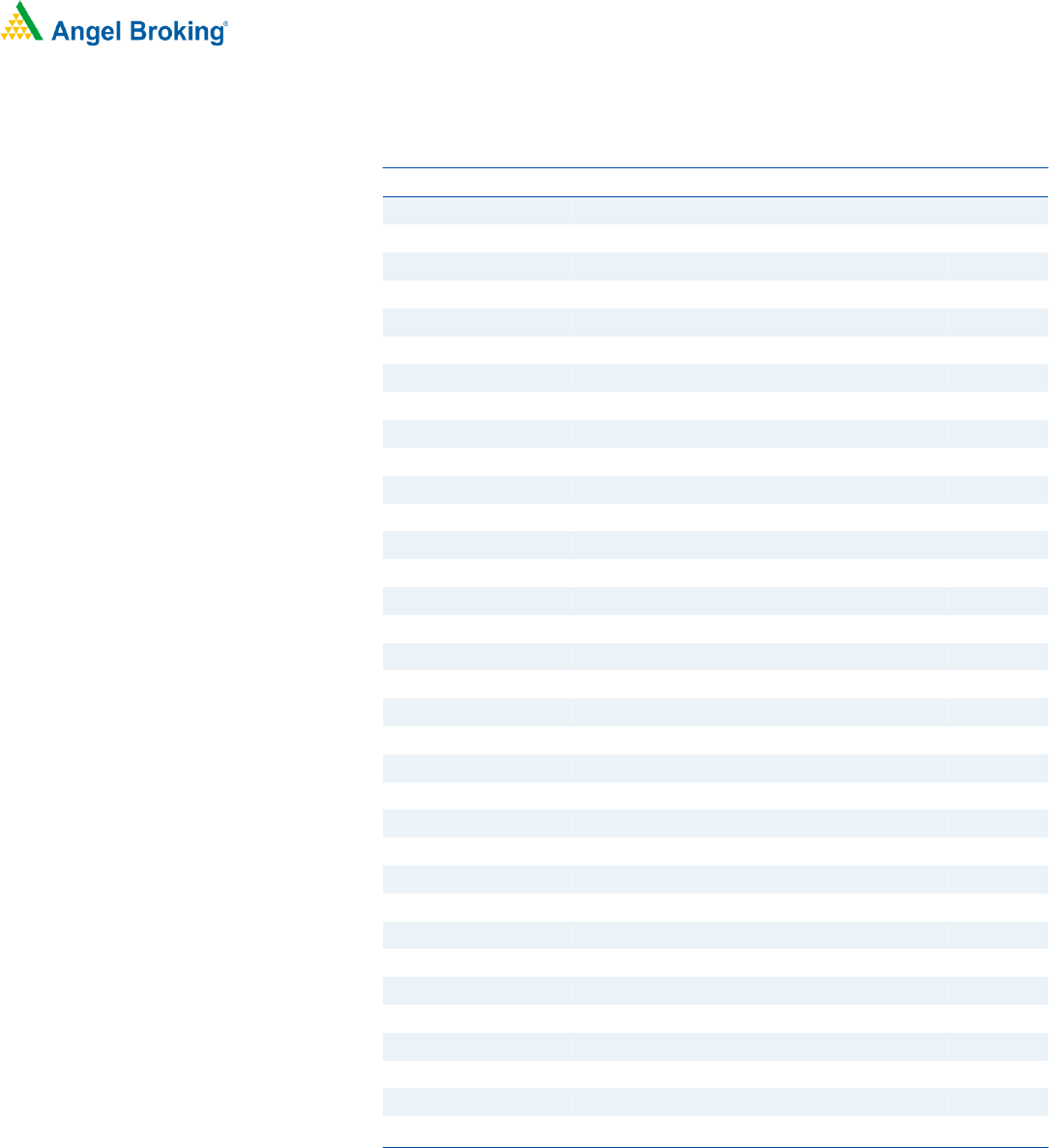

Particulars (` cr)

Q3FY20

Q2FY19

% chg (qoq)

Q3FY19

% chg (yoy)

NII

2,055

2,037

0.9

2,027

1.4

Pre. Prov. Profit

1,630

1,588

2.7

1,620

0.6

PAT

879

765

14.9

635

38.3

Source: Company, Angel Research

For Q3FY2020, STFC has reported a good set of numbers. For the quarter, PAT

increased 38% yoy led by lower credit cost, AUM growth continued to be

moderate at 5% yoy vs. 3.6% in Q2FY2020 and 14% in Q2FY2019.

Disbursement increased 19% yoy driven by used (20% yoy) and new (17% yoy).

AUM growth moderated; NIM declined: During the quarter, STFC reported AUM

growth of 5% yoy, led by working capital (33% yoy on low base) and used vehicle

loans (8% yoy), while AUM of new vehicles and business loans declined 13% yoy.

NIM declined by 30bps/5bps yoy/qoq owing to higher liquidity maintained on

balance sheet around `7,800cr. Management sounded confident to improve NIM

hereon as re-pricing of the existing loans and new borrowing is happening at a

lower rate.

Asset quality moderately improved, credit costs lowered; guidance maintained at

2%: On absolute term, Gross stage 3 sequentially remained flat and Gross stage

3 ratio declined 9bps to 8.71% of AUM. Asset improvement was largely owing to

normalization of Q2FY2020 rains/floods impact, subsequently, Gross stage 2

also improved. During the quarter, credit cost tapered down to 1.63% vs. 2.44%

in Q2FY2020, however, Management has guided that credit costs for next year

would be at 2%. We expect Gross stage 3 to improve gradually owing to (a) good

monsoon to improve borrower's financials, (b) with implementation of BS VI and

likely implementation of scrappage policy collateral value of the used vehicle will

stabilize/improve and consequently LGD would decline.

Outlook & Valuation: We expect STFC’s AUM to grow at moderate CAGR of 11%

over FY2019-22E, however, we expect operating parameter to improve at healthy

rate owing to improvement in NIM, asset quality. We expect STFC to report

RoA/RoE of 2.8%/17.3% in FY2021E. At CMP, the stock is trading at 1.6x

FY2021E ABV and 8x FY2021E EPS, which we believe is reasonable for a

differentiated business model with return ratios. We recommend a BUY on the

stock with a Target Price of `1,410.

Key Financials

Y/E March (` cr)

FY17

FY18

FY19

FY20E

FY21E

NII

5,561

6,800

7,808

8,305

9,307

YoY Growth (%)

10.1

22.3

14.8

6.4

12.1

PAT

1,257

2,460

2,562

2,922

3,449

YoY Growth (%)

6.7

95.7

4.2

14.0

18.0

EPS

55

108

113

129

152

Adj Book Value

367

459

563

655

778

P/E

22.0

11.3

10.8

9.5

8.0

P/Adj.BV

3.3

2.7

2.2

1.9

1.6

ROE (%)

11.7

19.8

17.4

17.1

17.3

ROA (%)

1.8

2.9

2.5

2.6

2.8

Valuation done on closing price of 11/02/2020

BUY

CMP 1,220

Target Price 1,410

Investment Period 12 Months

Stock Info

Sector

Bloomberg Code

Shareholding Pattern (%)

Promoters 26.3

MF / Banks / Indian Fls 3.1

FII / NRIs / OCBs 64.3

Indian Public / Others 6.4

Abs.(%) 3m 1yr 3yr

Sensex 2.2 13.2 45.5

SHTF 8.7 15.6 26.2

Beta

1.6

NBFC

Market Cap (` cr)

27,662

52 Week High / Low

1297/909

Avg. Daily Volume

81,808

Face Value (`)

10

BSE Sensex

41,216

Nifty

12,108

Reuters Code

SRTR.BO

SHTF IN

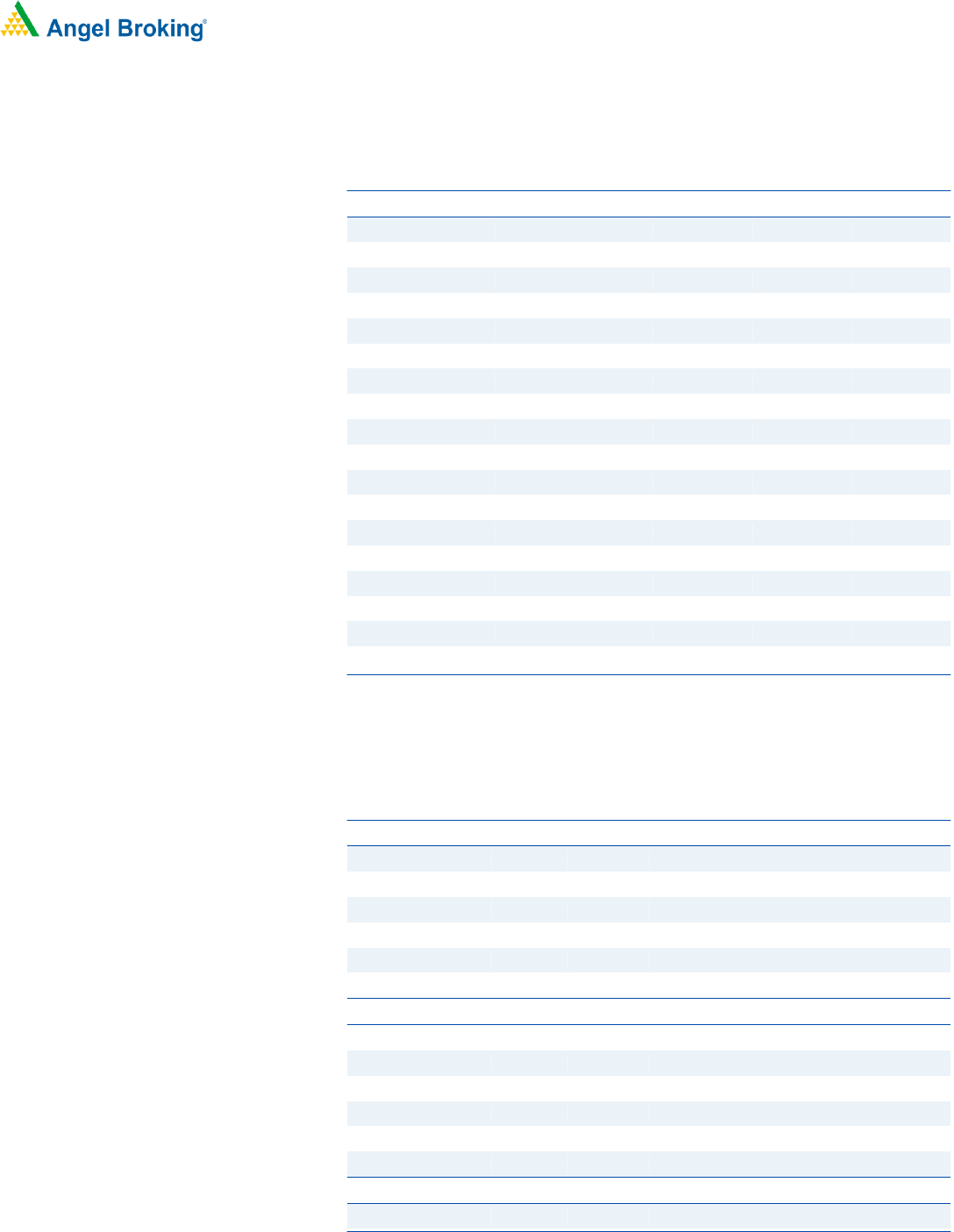

3 Year Price Chart

Source: Company

Jaikishan J Parmar

Research Analyst

022 39357600, Extn: 6810

jaikishan.parmar@angelbroking.com

500

700

900

1,100

1,300

1,500

1,700

Feb-17

Jun-17

Oct-17

Feb-18

Jun-18

Oct-18

Feb-19

Jun-19

Oct-19

Shriram Transport Fin Co

Performance Highlights

Quarterly results | NBFC

Feb 12, 2020

2

Quarterly results | Q3FY2020 Result Update

Feb 12, 2020

2

Exhibit 1: Income Statement

Particular (` cr)

2QFY19

3QFY19

4QFY19

Q1FY20

Q2FY20

Q3FY20

% QoQ

% YoY

Total Interest Income

3,917

3,968

3,845

4,001

4,113

4,133

0

4

Interest Expenses

1,862

1,941

1,939

2,040

2,076

2,078

0

7

Net Interest Income (NII)

2,055

2,027

1,906

1,962

2,037

2,055

1

1

Other Income

24

26

35

27

43

87

100

233

Total Income

3,942

3,994

3,880

4,029

4,156

4,220

2

6

Net Income

2,080

2,053

1,941

1,989

2,080

2,142

3

4

Operating Expenses

458

433

429

446

493

512

4

18

Employee Expenses

232

222

204

233

251

255

2

15

Other Operating Expenses

226

211

225

213

242

257

6

22

Operating Profit

1,622

1,620

1,512

1,543

1,588

1,630

3

1

Provisions

684

636

540

561

661

444

(33)

(30)

PBT

938

984

972

982

927

1,186

28

21

Provisions for Tax

329

348

226

347

162

308

90

(12)

Tax Rate %

35.1

35.4

23.3

35.4

17.5

25.9

49

(27)

PAT

609

635

746

634.2

765.1

878.8

15

38

Source: Company, Angel Research

Exhibit 2: Quarterly performance

AUM Mix (%)

2QFY19

3QFY19

4QFY19

Q1FY20

Q2FY20

Q3FY20

% QoQ

% YoY

New CV Loans

13

12

12

11.4

10.7

10.2

(58.1)bp

(214.6)bp

Used CV loans

87

88

88

88.6

89.3

89.8

58.1bp

214.6bp

Profitability

Cal NIM

8.02

7.79

7.32

7.44

7.60

7.58

(2.2)bp

(21.3)bp

NIM

7.44

7.44

7.16

7.16

7.19

7.14

(5)bp

(30)bp

C/I

22.0

21.1

22.1

22.4

23.7

23.9

21.6bp

281.4bp

ROE

17.0

17.2

19.4

15.8

18.4

20.2

181.8bp

304.3bp

Calc -Yield - AUM

15.29

15.25

14.77

15.18

15.34

15.23

(10.9)bp

(1.5)bp

Calc -Yield - Advance

18.40

18.42

18.13

18.86

19.42

19.40

(2.2)bp

97.8bp

Calc - COF

8.59

8.74

8.74

9.14

9.17

9.13

(4)bp

38.9bp

Spread

9.8

9.7

9.4

9.7

10.3

10.3

1.8bp

58.9bp

Exhibit 3: Break Up

Particular (` cr)

2QFY19

3QFY19

4QFY19

Q1FY20

Q2FY20

Q3FY20

% QoQ

% YoY

New

12,719

12,077

11,594

11,450

10,967

10,465

(5)

(13)

Used

86,057

86,126

87,050

89,021

91,215

92,626

2

8

Business Loan

3,314

3,182

2,971

2,912

2,852

2,649

(7)

(17)

Working Capital

2,171

2,365

2,807

2,898

3,027

3,142

4

33

Others

119

68

60

62

60

49

(18)

(28)

Total AUM

1,04,380

1,03,818

1,04,482

1,06,343

1,08,120

1,08,931

1

5

Source: Company, Angel Research

3

Quarterly results | Q3FY2020 Result Update

Feb 12, 2020

3

Exhibit 4: Asset Quality & Business Details

Asset Quality

2QFY19

3QFY19

4QFY19

Q1FY20

Q2FY20

Q3FY20

% QoQ

% YoY

Credit Cost (Annualized) AUM

2.6

2.5

2.1

2.1

2.4

1.6

(33)

(34)

GS 3

9,092

9,033

8,623

8,926

9,397

9,392

(0)

4

GS 3 %

8.71

8.70

8.25

8.52

8.80

8.71

(9)bp

1bp

ECL prov stage 3

3,113

3,187

2,967

2,841

3,017

3,018

0

(5)

Net Stage 3

5,979

5,846

5,656

6,085

6,380

6,375

(0)

9

Coverage Ratio Satge 3

34

35

34

32

32.1

32.1

2.5bp

(315.2)bp

GS 1& 2

96,173

93,875

94,358

95,889

97,406

98,385

1

5

ECL prov stage 1& 2

2,604

2,651

2,604

2,762

2,766

2,679

(3)

1

Net Stage 1 & 2

93,568

91,224

91,755

93,127

94,639

95,706

1

5

ECL Prov (%) Stage 1&2

2.71

2.82

2.76

2.88

2.84

2.72

(12)bp

(10)bp

Business Details (`)

AUM

1,04,380

1,03,818

1,04,482

1,06,343

1,08,120

1,08,931

1

4.93

Disbursement

13,799

9,550

11,959

12,300

13,120

11,607

(12)

22

New

2,300

400

8,100

890

666

476

(29)

19

Old

11,510

9,020

11,020

11,260

12,282

10,807

(12)

20

On book Loans

87,815

84,533

85,085

84,661

84,772

85,678

1

1

Off book (Securitization)

16,565

19,285

17,223

19,750

21,691

21,805

1

13

DA

24

1,721

2,175

1,942

1,657

1,448

(13)

(16)

Source: Company, Angel Research

Outlook & Valuation: We expect STFC’s AUM to grow at moderate CAGR of

11% over FY2019-22E, however, we expect operating parameter to improve

at healthy rate owing to improvement in NIM, asset quality. We expect STFC to

report RoA/RoE of 2.8%/17.3% in FY2021E. At CMP, the stock is trading at

1.6x FY2021E ABV and 8x FY2021E EPS, which we believe is reasonable for a

differentiated business model with return ratios. We recommend a BUY on the

stock with a Target Price of `1,410.

4

Quarterly results | Q3FY2020 Result Update

Feb 12, 2020

4

Income Statement

Y/E March ( `cr)

FY17

FY18

FY19

FY20E

FY21E

NII

5,561

6,800

7,808

8,305

9,307

- YoY Growth (%)

10.1

22.3

14.8

6.4

12.1

Other Income

82

215

101

110

122

- YoY Growth (%)

-55.5

162.8

-53.0

8.9

10.6

Operating Income

5,643

7,015

7,909

8,415

9,429

- YoY Growth (%)

7.8

24.3

12.7

6.4

12.1

Operating Expenses

1,275

1,492

1,750

2,028

2,252

- YoY Growth (%)

-5.4

17.0

17.3

15.9

11.0

Pre - Provision Profit

4,368

5,524

6,159

6,387

7,177

- YoY Growth (%)

12.3

26.4

11.5

3.7

12.4

Prov. & Cont.

2,444

1,722

2,382

2,430

2,568

- YoY Growth (%)

16.0

-29.5

38.3

2.0

5.7

Profit Before Tax

1,924

3,801

3,776

3,957

4,610

- YoY Growth (%)

8.0

97.6

-0.7

4.8

16.5

Prov. for Taxation

667

1,341

1,214

1,035

1,160

- as a % of PBT

34.6

35.3

32.1

26.2

25.2

PAT

1,257

2,460

2,562

2,922

3,449

- YoY Growth (%)

6.7

95.7

4.2

14.0

18.0

Balance Sheet

Y/E March ( ` cr)

FY17

FY18

FY19

FY20E

FY21E

Share Capital

227

227

227

227

227

Reserve & Surplus

11,075

13,349

15,609

18,196

21,248

Net worth

11,302

13,576

15,836

18,422

21,475

Borrowing

53,110

82,131

87,968

95,885

1,06,432

- YoY Growth (%)

6.7

54.6

7.1

9.0

11.0

Other Liab. & Prov.

9,998

1,539

1,487

1,291

1,024

Total Liabilities

74,410

97,245

1,05,291

1,15,598

1,28,932

Investment

1,549

2,341

3,999

3,999

3,999

Cash

4,441

3,675

3,981

4,571

5,077

Advance

65,463

90,738

96,751

1,06,426

1,19,197

- YoY Growth (%)

5.8

38.6

6.6

10.0

12.0

Fixed Asset

84

120

147

154

162

Other Assets

2,874

383

413

448

497

Total Asset

74,410

97,257

1,05,291

1,15,598

1,28,932

Growth (%)

9.5

30.7

8.3

9.8

11.5

5

Quarterly results | Q3FY2020 Result Update

Feb 12, 2020

5

Key Ratio

Y/E March

FY17

FY18

FY19

FY20E

FY21E

Profitability ratios (%)

NIMs

8.5

8.5

8.1

7.9

8.0

Cost to Income Ratio

22.6

21.3

22.1

24.1

23.9

RoA

1.8

2.9

2.5

2.6

2.8

RoE

11.7

19.8

17.4

17.1

17.3

Asset Quality (%)

Gross NPAs

8.20

9.15

8.3

8.0

7.5

GNPA (` Cr)

5,408

7,376

7,100

8,514

8,940

Net NPAs (%)

2.7

2.83

2.6

2.4

2.4

NPA (` Cr)

1,659

2,131

2,055

2,554

2,861

Provision Coverage

67.1

69.1

69.2

70.0

68.0

Credit Cost (AUM)

3.1

1.8

2.3

2.0

1.9

Per Share Data (`)

EPS

55

108

113

129

152

ABVPS

367

459

563

655

778

DPS

10

11

13

15

17

BVPS

498

598

698

812

947

Valuation Ratios

PER (x)

22.0

11.3

10.8

9.5

8.0

P/ABVPS (x)

3.3

2.7

2.2

1.9

1.6

P/BVPS

2.4

2.0

1.7

1.5

1.3

Dividend Yield

0.8

0.9

1.1

1.2

1.4

DuPont Analysis

FY17

FY18

FY19

FY20E

FY21E

NII

7.8

7.9

7.7

7.5

7.6

(-) Prov. Exp.

3.4

2.0

2.4

2.2

2.1

Adj. NII

4.4

5.9

5.4

5.3

5.5

Other Inc.

0.1

0.3

0.1

0.1

0.1

Op. Inc.

4.5

6.2

5.5

5.4

5.6

Opex

1.8

1.7

1.7

1.8

1.8

PBT

2.7

4.4

3.7

3.6

3.8

Taxes

0.9

1.6

1.2

0.9

0.9

RoA

1.8

2.9

2.5

2.6

2.8

Leverage

6.6

6.9

6.9

6.4

6.1

RoE

11.7

19.8

17.4

17.1

17.3

Valuation done on closing price of 11/02/2020

6

Quarterly results | Q3FY2020 Result Update

Feb 12, 2020

6

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER:

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National

Commodity & Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and

Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-

managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any

investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this

document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in

the securities of the companies referred to in this document (including the merits and risks involved), and should consult their

own advisors to determine the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions

and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a

company's fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our

website to evaluate the contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other

reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as

such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be

in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information

contained in this report. Angel Broking Limited has not independently verified all the information contained within this

document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy,

contents or data contained within this document. While Angel Broking Limited endeavors to update on a reasonable basis the

information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be

reproduced, redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise

from or in connection with the use of this information.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise

from or in connection with the use of this information..

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or

damage that may arise from or in connection with the use of this information.

Disclosure of Interest Statement Shriram Transport Fin

1. Financial interest of research analyst or Angel or his Associate or his relative No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives No

3. Served as an officer, director or employee of the company covered under Research No

4. Broking relationship with company covered under Research No

Ratings (Based on Expected Returns: Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

over 12 months investment period) Reduce (-5% to -15%) Sell (< -15%)

Hold (Fresh purchase not recommended)